In a board meeting at Demandware where we were debating where to invest among many choices, a board member noted that “we are drowning in a sea of opportunities”. In a rapidly growing SaaS company, it often feels that way. It usually has, by definition, a wide variety of opportunities it can pursue. There are more good opportunities to pursue than there are capabilities to pursue them all. Frequently, with the goal of not foregoing any opportunities, too many are being worked to the detriment of a focus on the ones most vital for success. A number of the companies spend one day per year in a strategy meeting with the executive team and the board. The goal is to take a longer term outlook (often three years) in order to decide where to invest and determine what additional resources (human and capital) the company needs to optimize its success over that period. This is a particularly important process when the company has just raised capital as there is often a temptation after a capital raise to do too much, not recognizing that even with plenty of cash, there is still a very important human capacity limitation (especially among founders and top management) that necessitates a focus on only the most important priorities.

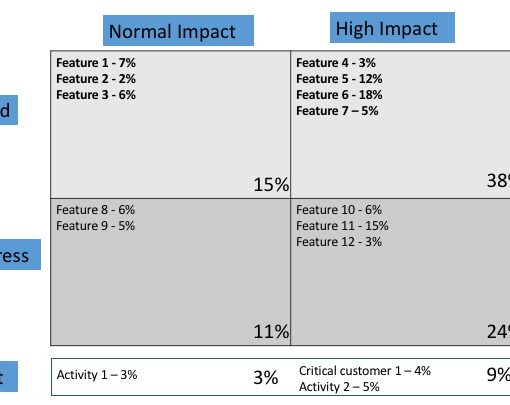

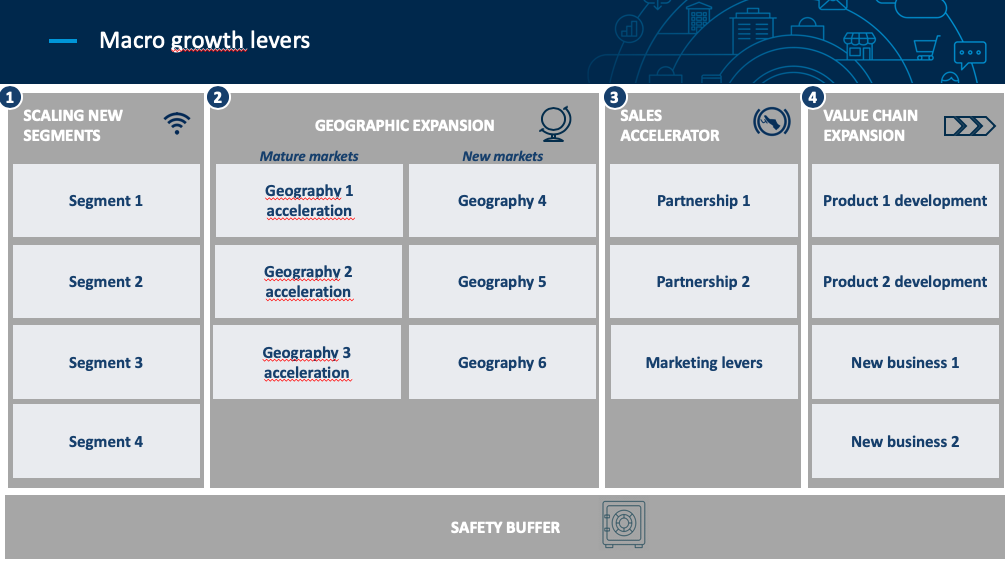

I participated in a clever and extremely effective way to make these decisions (which I am shamelessly stealing for this blog entry). To explain the exercise, assume that the company raised $20M and that the strategy group is composed of investors/board members and members of the executive team. The two groups were separated to get their independent perspectives and each was given ten slips of paper representing $2M each. (They could not be torn or divided.) They were both given the same chart (see sample)

and then given thirty minutes to place the $2M on the opportunities in which they thought the incremental investment capital should be spent over the next three years. They could put all ten on one priority or spread them around however they felt best optimized the company’s success. At the end of this thirty minutes, the two groups reconvened, and each went through the result of its discussion, explaining its rationale. There were some differences but a remarkable amount of overlap. The result was that less than half of the potential opportunities received all of the incremental investment and this helped the executive team determine what the focus of the next year’s plan should be.

There are undoubtedly many other ways to accomplish a similar result, but this one worked beautifully.